In our previous article, we shared insights on selecting tools for testing a website. Now, let’s delve into identifying the most effective ecommerce payment solutions. Read the last article here.

Introduction to eCommerce Payment Solutions

In the preceding segment of our comprehensive guide on creating an ecommerce website from the ground up, we explored various strategies to optimize ecommerce images. This segment is dedicated to helping you select the most suitable ecommerce payment solutions for your online store.

The value of the global digital payment market is projected to grow at a CAGR of 20.5% by 2030. Hence, prioritizing the selection of an apt ecommerce payment solution is crucial for ecommerce entrepreneurs.

However, the task of choosing the most fitting solution can be daunting, given the plethora of payment methods accessible to customers. It’s essential to weigh aspects such as transaction speed, security, reliability, and ease of integration. The global economy has already incurred a loss of $118.5 billion due to failed payments, as 60% of businesses have experienced customer loss, among other repercussions. Such payment discrepancies can adversely impact customer retention.

To assist you in making an informed decision, we have assembled a list of the top 13 proven ecommerce payment solutions. Let’s explore them!

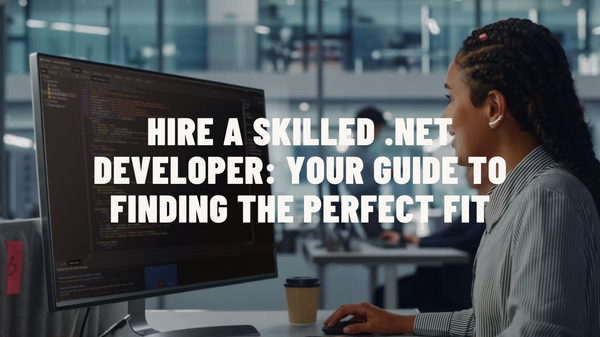

1. PayPal

PayPal, with its extensive user base of over 400 million active users and 30 million merchants globally, stands as a top choice for payment platforms. For those stepping into the realm of eCommerce, integrating PayPal can significantly enhance brand trust, as it is observed that customers exhibit a 54% increased willingness to make purchases when PayPal is an available option. Thus, it assures businesses of reaching their consumers effectively.

PayPal is adept at addressing diverse payment preferences, enabling customers to execute payments from any corner of the world through their favored payment methods.

Features

- Offers varied payment alternatives including online checkout, mobile app payments, and social media transactions.

- Enables email transactions and installment-based payments through 'Pay Later'.

- Facilitates recurring subscription charges and supports over 100 currencies, providing localized payment options in specific areas.

- Integrates with all principal marketplaces and allows acceptance of payments from over 200 markets through various modes like PayPal, Venmo, Debit and Credit cards, and more.

- Generates invoices, estimates, reports, and customizable, shareable payment links.

Benefits

- User-friendly, dependable, and secure.

- Eliminates currency conversion complexities.

- Sends payment requests to customers via their email addresses.

- Enhances business visibility and allows centralized tracking of all PayPal transactions from diverse marketplaces.

Limitations

- Possesses high chargeback fees and customer support accessibility is challenging.

- Small transactions may incur high costs, and account may be frozen for violation of terms and conditions.

Pricing

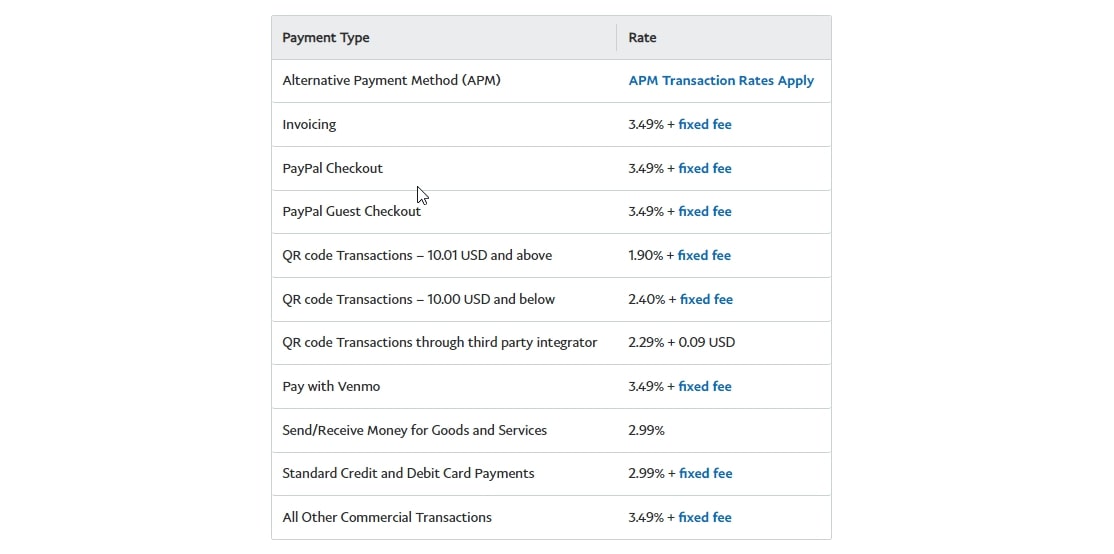

PayPal’s fee structure varies based on market/region, with a 1.50% charge for receiving international payments from customers.

Best Suited For

Emerging online retail stores aiming to establish a consumer base and large-scale corporations.

2. Apple Pay

Apple Pay serves as an exceptional tool for those utilizing Apple devices, facilitating quicker checkouts for acquisitions made via the Safari Browser on Mac or iOS devices.

Its goal is to supersede physical cards, offering a confidential and more secure payment method that is more convenient.

To execute a transaction, Apple users simply touch the Apple Pay icon and scan their fingerprints. This spares them the effort of inputting card and shipping information.

Features

- straightforward to configure

- automatically recognizes Apple users

- guarantees privacy and security for both merchants and customers (Apple maintains customer data confidential!)

Benefits

- free, swift, and simpler integration compared to card or cash transactions

- delivers ultra-fast payment processing and checkouts

- enables customers to transact through an iMessage app and Messages for Business or directly on your site

- resonates with a younger, mobile-savvy demographic; businesses aiming at school and college students stand to gain significantly

- eradicates obstacles for customers during checkout

- no additional hardware or terminal required for payment acceptance

Limitations

- exclusive to Apple Users

- necessitates an SSL-certified domain and a distinct payment gateway

Pricing

Receiving payments via Apple Pay is cost-free. However, transaction fees for your chosen payment gateway will apply.

Best Suited For

Businesses in retail, fashion, manufacturing, and food & beverage sectors aiming to cater to a specialized segment of Apple device users.

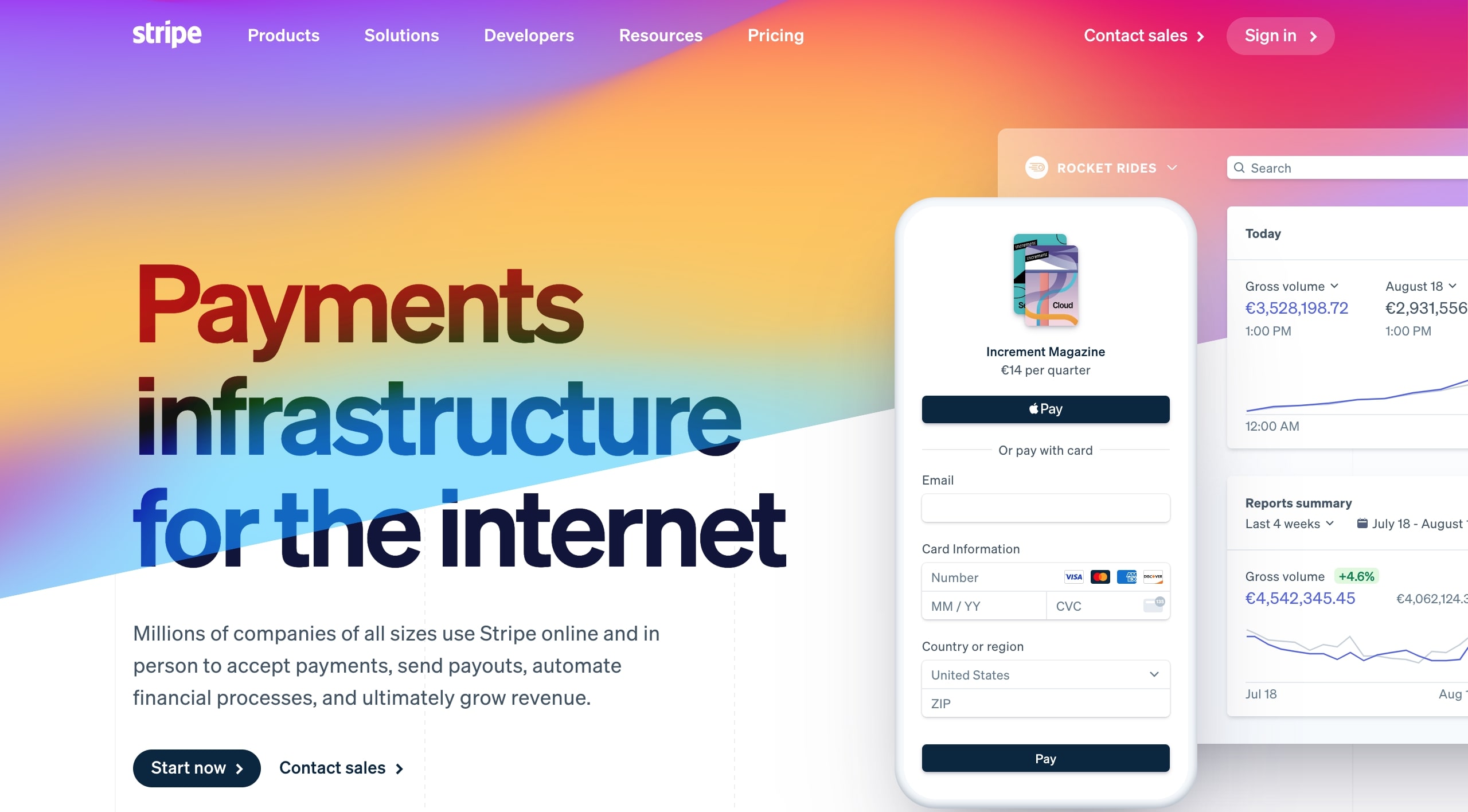

3. Stripe

Stripe is emerging as a robust online payment solution, extending its services to millions of enterprises, both small and large, across the world. Renowned companies such as Wayfair, Peloton, and Warby Parker rely on Stripe for their payment needs.

It provides a highly adaptable platform, allowing businesses to receive payments, disburse payouts, and manage their operations online.

Stripe employs machine learning to identify potential fraudulent activities and optimize conversions.

Features

- facilitates swift and straightforward integration with multiple payment options

- processes payments in over 135 currencies

- employs Stripe Radar for early fraud detection

- ensures secure transactions with dynamic 3D security

- available 24/7 customer support through email, live chat, and phone.

Benefits

- supports a diverse array of payment options

- customizes checkout experiences for users by adjusting to their language and device

- accommodates various global payment methods

Limitations

- may be costly for smaller enterprises

- has a more developer-focused interface, which can be challenging to navigate

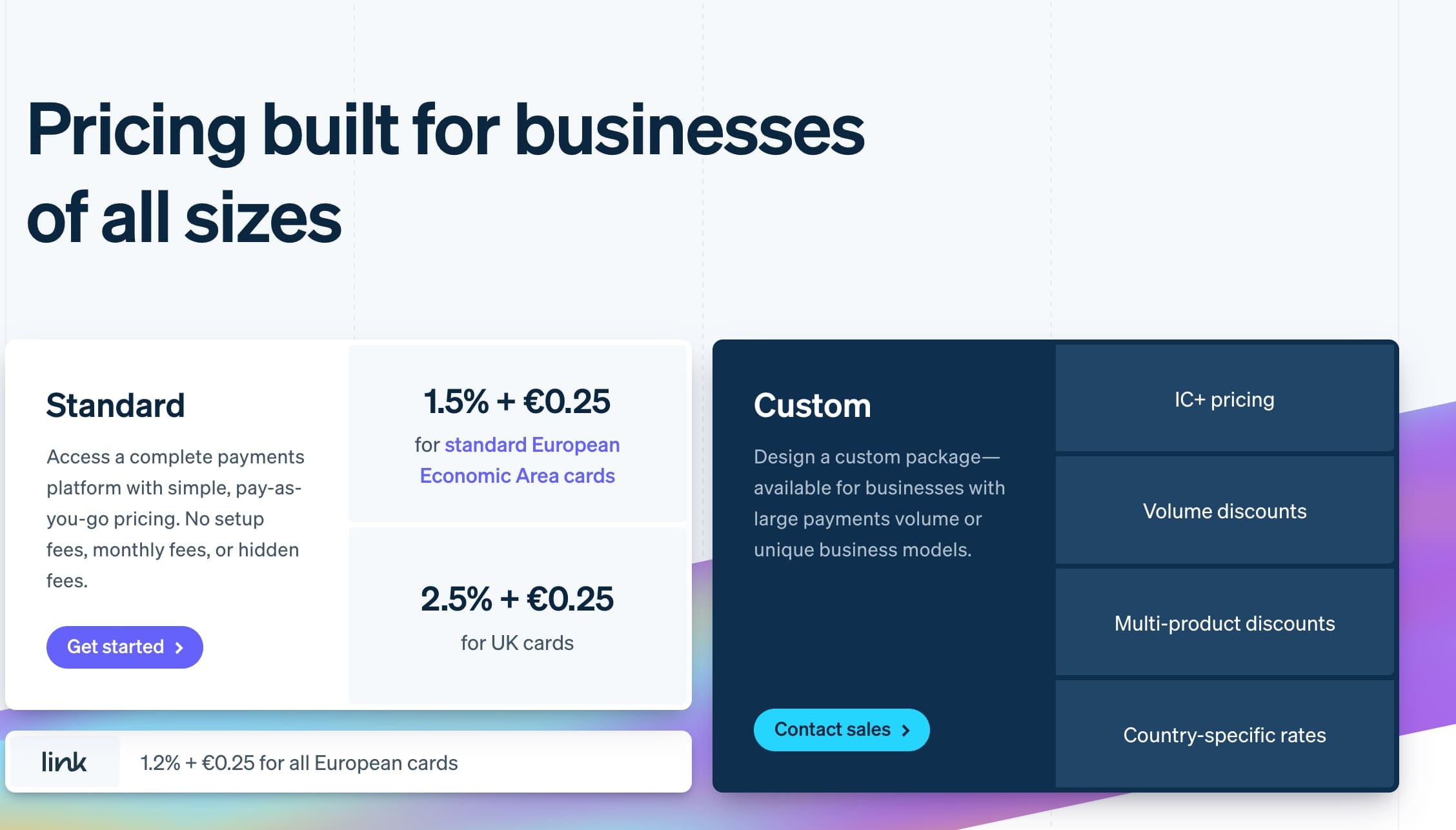

Pricing

Refer to the Pricing Structure of Stripe for detailed information.

Best Suited For

Large-scale eCommerce corporations in the retail and IT sectors.

4. Google Pay

Google Pay (GPay) stands out as an optimal payment method for those seeking a secure location for customers to keep their debit and credit cards. It streamlines the checkout experience for consumers by safely storing their details and allowing payments with just a simple tap.

Given Google's renowned reputation, it is a widely embraced payment solution, trusted for its security measures. It employs tokenization to keep customers' card details, ensuring these details remain confidential, providing an extra layer of security for your customers.

Features

- facilitates smooth and straightforward payment transactions

- offers attractive incentives such as rewards and cashbacks to encourage users to transact

- provides insights into your sales data

- enables the creation of a personalized business channel for your store within the app at no cost

- features integrated templates for dispatching reminders, receipts, and tickets to your customers

Benefits

- offers an uncomplicated and cost-free integration

- is a secure and reliable platform, gaining customers' trust

- presents rewards and exclusive deals for utilizing the app for business transactions

- ensures quick checkouts for your customers

- imposes no fees on you or your customers

Limitations

- is not accessible for businesses located in France

- requires the integration of a payment gateway for activation in your store

- the Google Pay button is displayed only on selected browsers: Google Chrome, Mozilla Firefox, and UC Browser

Pricing

Receiving payments through Google Pay is free of charge. However, transaction fees for your payment gateway will apply.

Best Suited For

Businesses in retail, fashion, and manufacturing sectors that prioritize top-notch security for themselves and their customers.

5. Masterpass

Now known as “Click to Pay,” Masterpass is designed to make payments as simple as a single click. It allows consumers to store their credit and debit card information and make purchases without the need to enter payment details each time.

Moreover, the platform's encryption technology guarantees the utmost security for the stored payment details. This feature also relieves customers from the burden of remembering passwords or re-saving payment details whenever they switch devices.

Features

- enables ultra-fast 3-step checkouts

- incorporates robust security measures, including advanced bot detection

Benefits

- provides consumers with a Zero Liability Protection policy, safeguarding against fraud

- presents multiple checkout options for merchants to attract and retain customers

Limitations

- offers fewer features compared to other digital wallet solutions

Pricing

Utilizing Masterpass incurs no charges for merchants.

Best Suited For

Businesses in the retail and manufacturing sectors that value quick and efficient checkouts.

6. Amazon Pay

Amazon Pay is not just a button — it’s a symbol of a brand that is recognized and trusted by your customers.

Amazon provides this secure and dependable service allowing your customers to utilize the credit and debit card details saved on their Amazon accounts to execute online payments swiftly and securely.

By eliminating the need for customers to set up an account during checkout and significantly reducing the time spent, Amazon Pay aids in enhancing conversion rates.

Features

- provides a versatile checkout button on your product pages

- accessible in over 170 countries

- supports transactions in 12 different currencies through its multi-currency feature

Benefits

- provides excellent technical and dedicated account support

- ensures quick and straightforward integration

- supports recurring payments, facilitating customers in subscribing, bill payments, and future purchases

- minimizes high-risk transactions and protects against chargebacks

- processes payments 49% faster compared to regular checkouts

Limitations

- supports only a limited number of currencies

- unavailable for stores in several countries

Pricing

An additional 1% fee is charged for cross-border transactions.

Best Suited For

Businesses based in the U.S. in the retail, fashion, or manufacturing sectors that already have an Amazon seller account.

7. Square

Square is committed to aiding “businesses to expand both offline and online.” It presents a diverse array of payment alternatives, including Magstripe, chip cards, and contactless payment methods to your clientele.

Additionally, Square provides a comprehensive suite of features for small enterprises, incorporating additional solutions like scheduling appointments, payroll, and managing employees. You have the capability to create and dispatch digital invoices to your clientele or “sell through text.”

It also integrates flawlessly with multiple third-party eCommerce platforms.

Features

- serves as an excellent eCommerce website creator

- grants a complimentary domain and online storefront

- introduces “purchase now and settle later” via Afterpay

- possesses adaptable omnichannel commerce instruments

- provides supplementary services for evolving businesses

Benefits

- incurs no monthly charges

- maintains uniform and competitive transaction fees for all principal cards

- is devoid of enduring contracts

- enables selling telephonically through Square Virtual Terminal

Limitations

- is not suitable for merchants with high-risk profiles

- functions as a payment gateway only in the US, U.K., Canada, Australia, and Japan

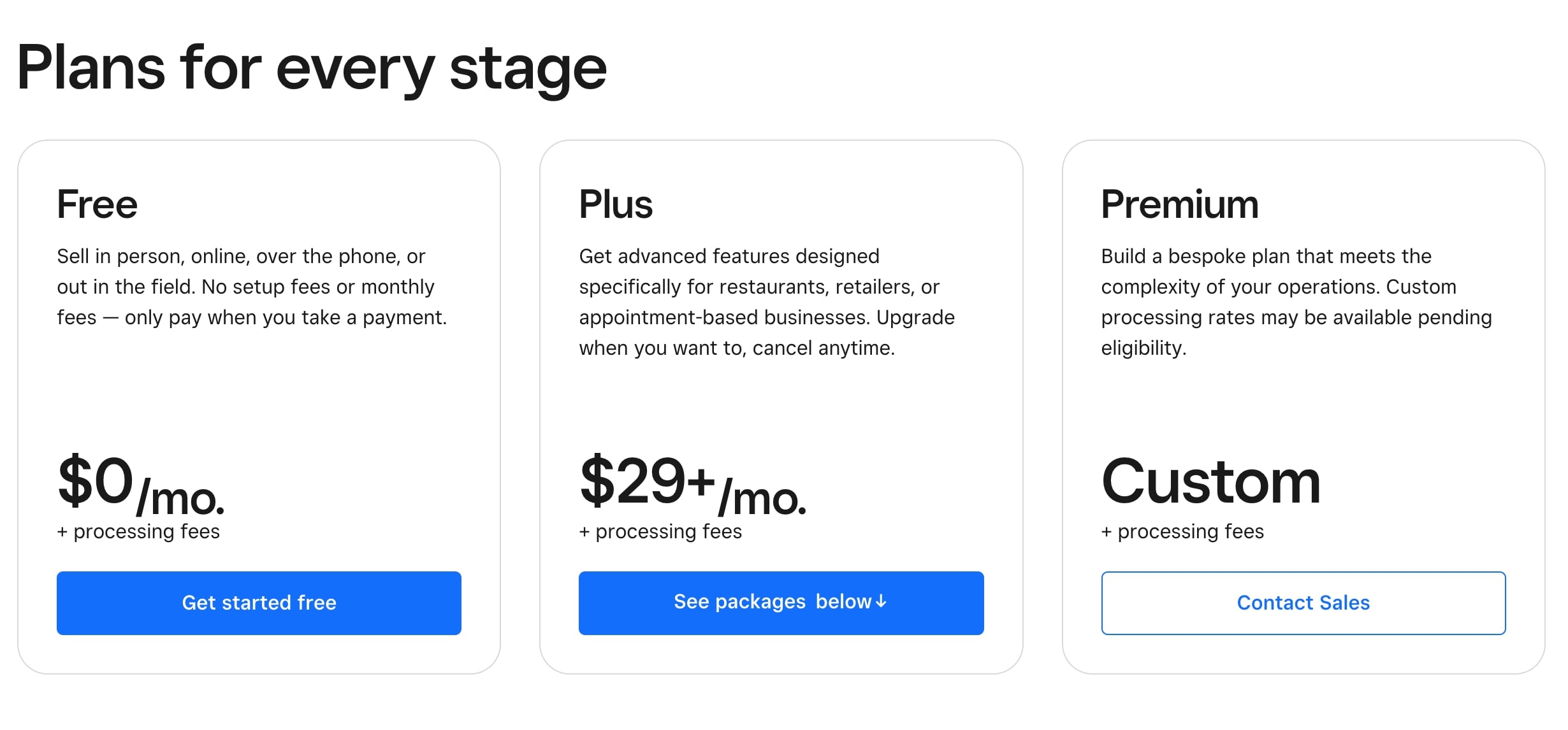

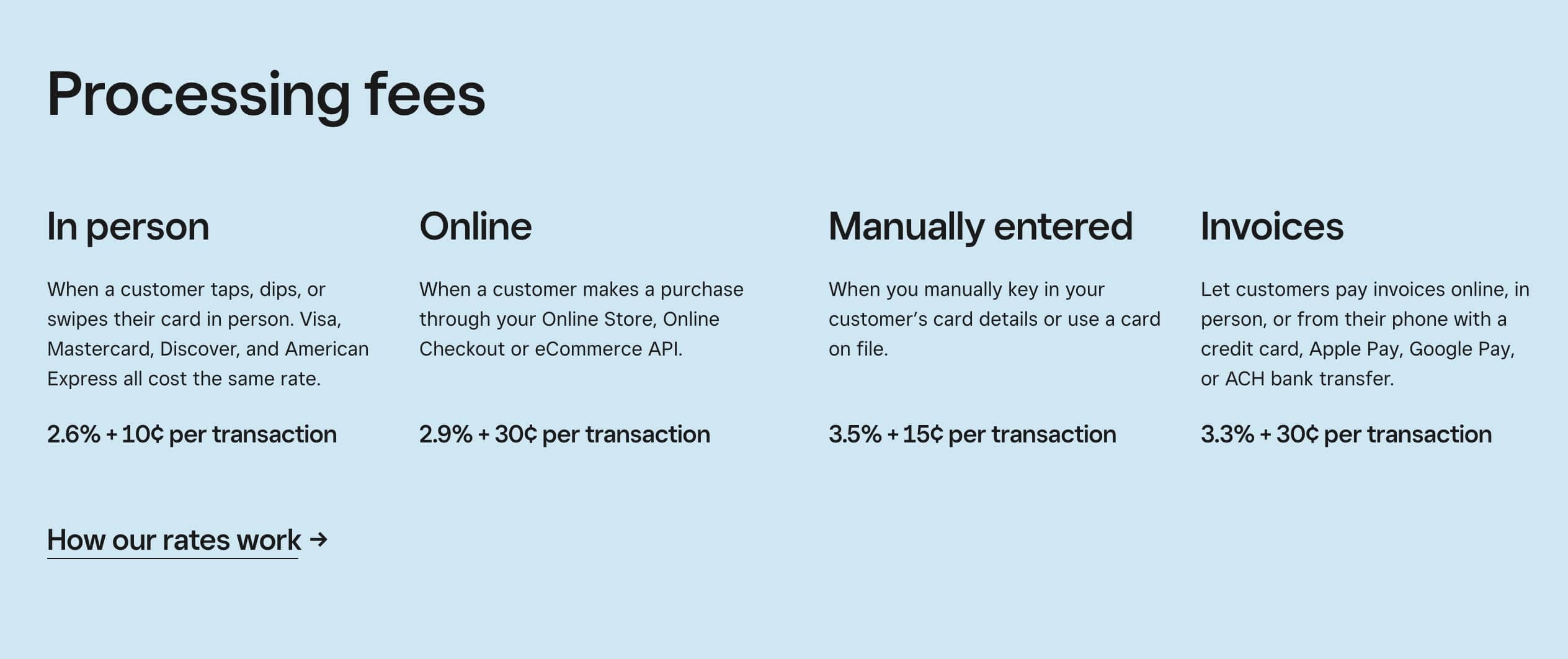

Pricing

Best Suited For

Enterprises in retail, beauty and wellness, food and beverage, and services seeking a comprehensive point of sale solution with integrated payment processing.

8. Authorize.net

Authorize stands out as another multifaceted payment gateway, enabling you to present a variety of payment options to your customers. It is designed to facilitate payments at any time, from any location.

To utilize Authorize, a merchant account is required, which can either be acquired from their providers or independently.

It empowers you to accept payments from customers through various means, including credit cards, debit cards, PayPal, and Google Wallet.

Features

- provides customization possibilities, dependable customer support, and superior fraud defense

- notifies users of questionable transactions

- includes eChecks as an additional electronic payment method

- imposes no restrictions on transaction volumes

- supports transaction processing in multiple currencies

Benefits

- shields your eCommerce venture from high-risk orders

- ensures quick and automated fund transfers to your bank account

- guarantees elevated data encryption security during payment processing

Limitations

- necessitates a distinct merchant account

- the user interface is not particularly user-friendly or appealing

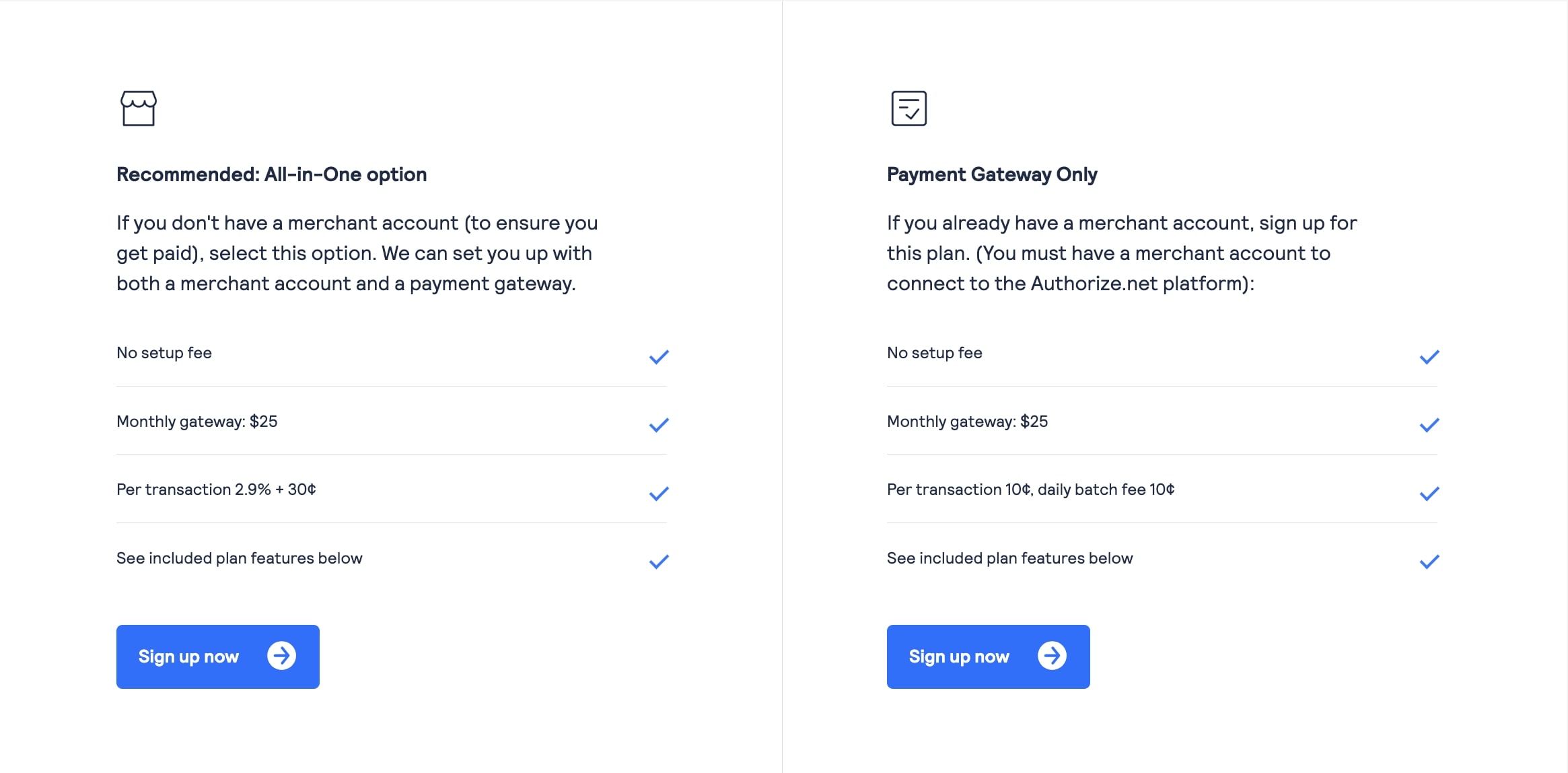

Pricing

Best Suited For

Small enterprises in retail, manufacturing, and computer software industries seeking a direct payment gateway with an emphasis on security and customer support.

9. 2CheckOut

2CheckOut, now known as Verifone, specializes in global payment processing, allowing you to receive payments from a broader range of countries compared to PayPal. It serves as a comprehensive monetization platform, focusing on optimizing your revenue and simplifying online sales processes.

Additionally, it caters to various eCommerce payment requirements including subscription billing and taxes, and offers customization options to incorporate additional features as your business expands.

Features

- imposes no setup or monthly charges

- presents various customizable checkout alternatives

- supports integrations with over 100 online carts, an API, and a sandbox

- accommodates 87 currencies, eight payment methods, and is available in 15 languages

- employs advanced fraud protection with over 300 security rules per transaction

Benefits

- facilitates the configuration of recurring billing

- delivers mobile-responsive, branded, and localized checkout experiences

- accepts all predominant payment methods, including credit cards, debit cards (Visa, MasterCard, Maestro), and PayPal transactions

Limitations

- incurs a $20 fee for every chargeback

- applies an additional 1% fee to customers from the US

- the average currency conversion fee is 2-5% above the daily bank exchange rate

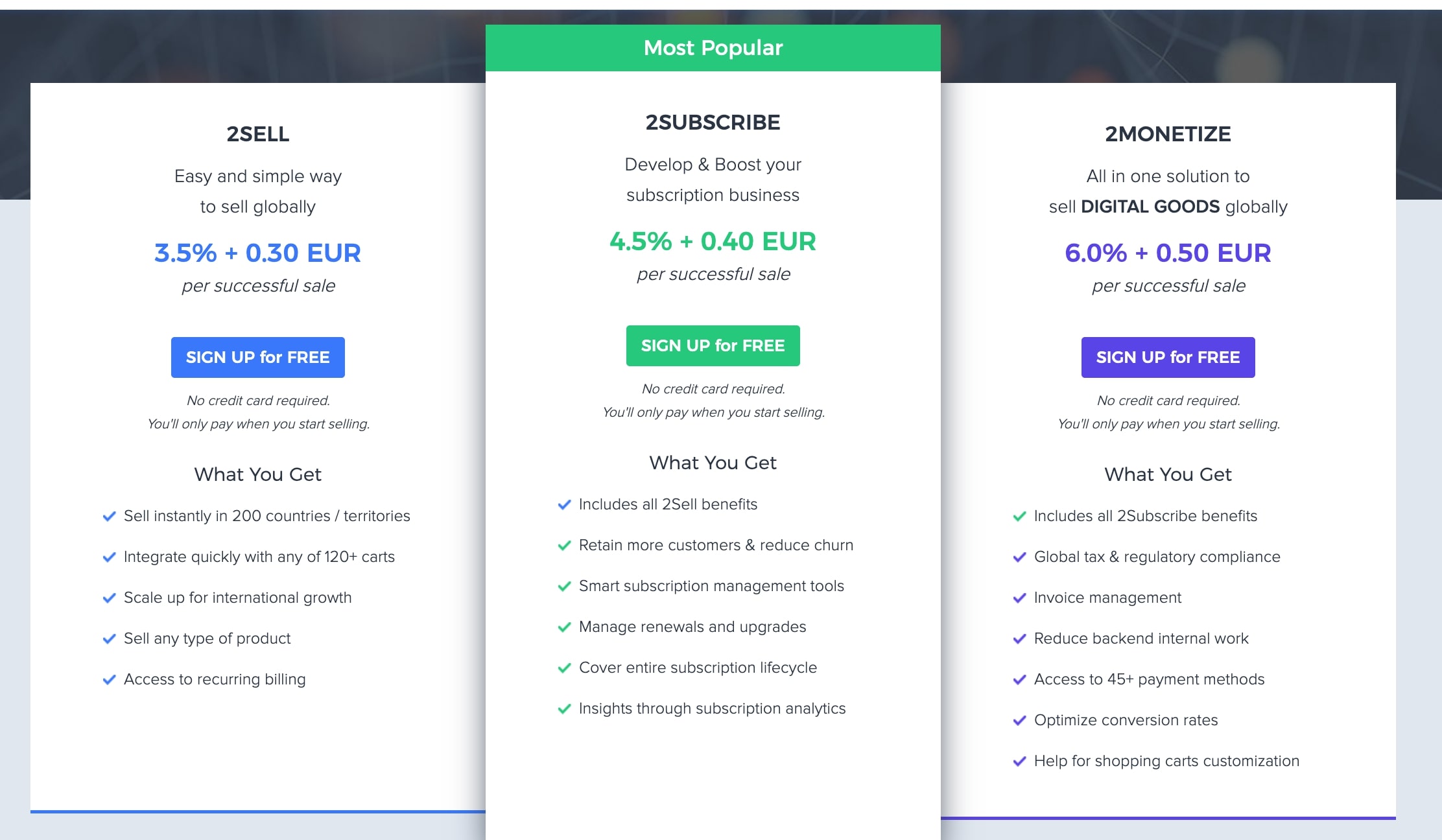

Pricing

Best Suited For

Businesses in the service sector, particularly those in the computer software industry.

10. Adyen

Adyen positions itself as a comprehensive solution catering to payments, data, and financial management needs. It provides merchants with a unified platform, allowing the addition of new payment methods, expansion to new markets, consolidation of cross-channel insights, and fraud detection.

Renowned technology entities like Spotify and Etsy rely on Adyen for processing their online payments.

Features

- serves as a payment gateway

- facilitates integration for in-app or mobile transactions

- encompasses various optimization tools

- incorporates superior security features

Benefits

- imposes no setup or monthly charges

- acts as a holistic eCommerce payment processing solution

- delivers insights driven by machine learning technology

- consolidates in-store and online payment data in a single location

- ensures user-friendly authentication

Limitations

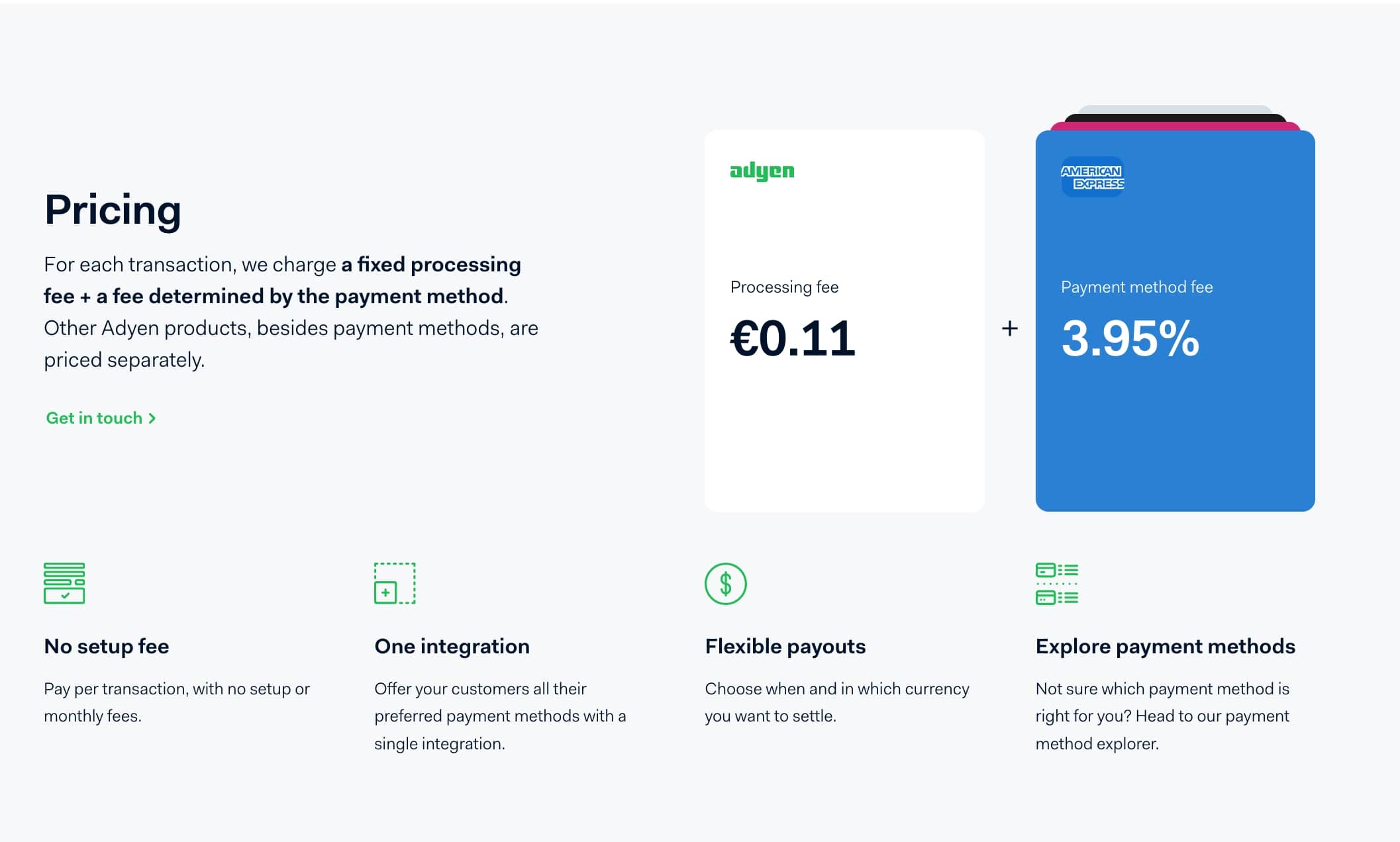

- Employs a complicated pricing structure

Pricing

Best Suited For

Enterprises operating across multiple channels and in need of a merchant account.

11. Payline Data

Payline Data makes handling payments effortless through its varied solutions for mobile, online, and in-store transactions.

It also comes with added functionalities like a credit card reader, a virtual terminal, and seamless integration with QuickBooks, enabling the acceptance of cards online using any device connected to the internet.

Features

- is adaptable

- includes a built-in calculator to forecast your monthly fees

- provides an extensive selection of in-store credit card processing packages

- Comprehensive API for integrations with third-party platforms

Benefits

- delivers smooth reporting to monitor sales

- employs a clear pricing structure

- processes your funds in just one day

Limitations

- currently only available in the US

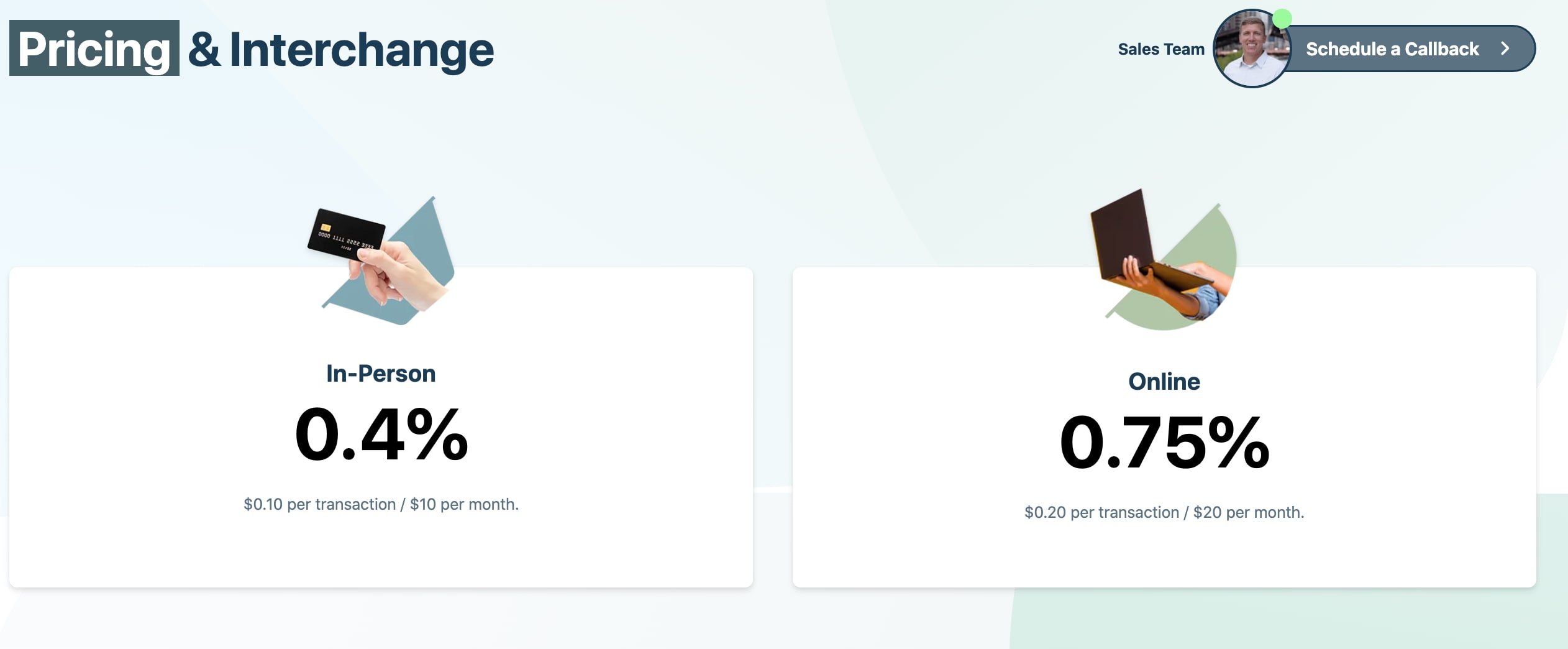

- features a complicated pricing system

Pricing

Payline employs an interchange-plus pricing model, so the fee is determined by the kinds of cards you process during a payment cycle.

Best Suited For

Enterprises conducting high-risk and high-volume transactions.

12. Shopify Payments

While Shopify primarily aims to assist entrepreneurs in creating efficient eCommerce websites, it also provides a proficient payment solution.

Shopify Payments encompass nearly all digital payment services, offering a secure online payment solution available to all Shopify merchants.

It enables customers to make payments through major credit cards and payment providers such as Visa, Mastercard, American Express, Apple Pay, Google Pay, and others.

Features

- facilitates 3D secure checkouts

- enables effortless payment tracking

- supports automatic currency conversion

- features lower processing fees compared to other payment gateways

Benefits

- processes payments in local currencies

- conducts automatic fraud analysis on store orders

- allows savings of up to 2% on transaction fees with third-party payment gateways

- offers shipping insurance of up to $200 when using Shopify Shipping

- eliminates the need for complex integrations

Limitations

- not available for stores in certain countries

- there is a delay in processing payments

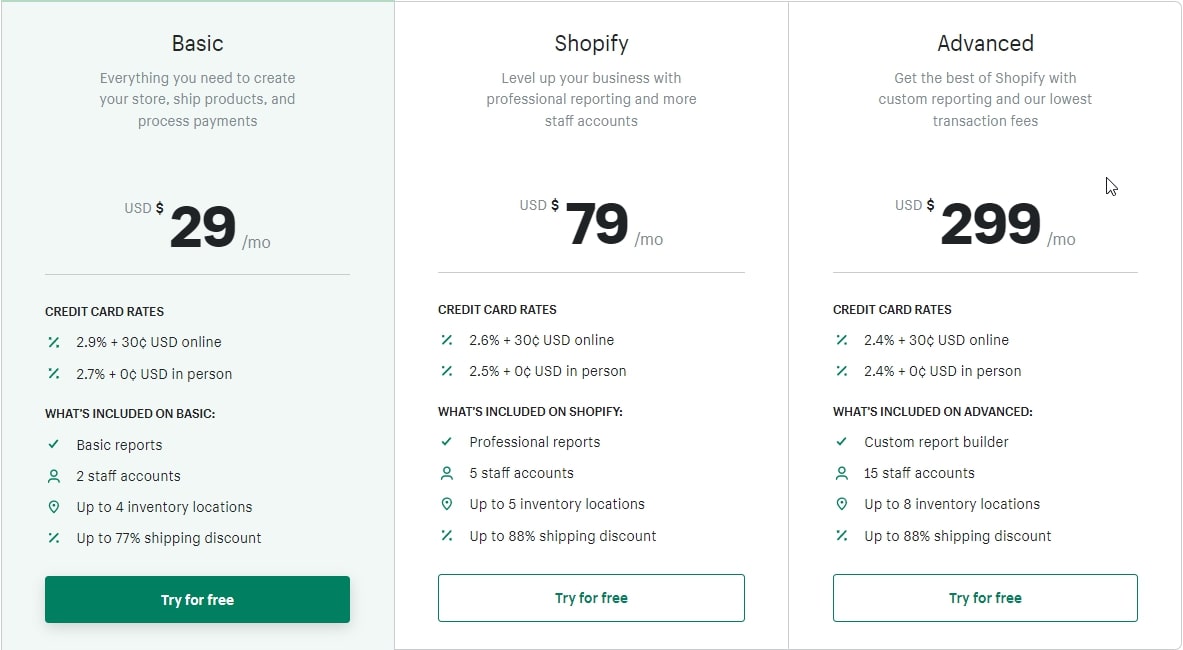

Pricing

Best Suited For

Enterprises utilizing Shopify for their eCommerce platform and POS system.

13. Klarna

Klarna stands out for its innovative AI technology that enables “buy now, pay later” options, giving consumers the liberty to choose their preferred payment methods.

It also allows your store to integrate seamlessly with different e-commerce platforms, apps, and social media sites.

It offers four distinct payment choices to your customers:

- Four interest-free installments

- Pay within 30 days

- Pay within 24 months

- Pay immediately

Features

- Offers an intuitive and streamlined checkout process

- Guarantees payment to merchants at the time of checkout

- Allows for easy and efficient integration

Benefits

- Enables customers to obtain and use products, paying after receipt

- Ensures you receive immediate and full payment, even when the customer chooses to pay later

- Boosts business and revenue by offering versatile payment options

- Provides smooth checkouts for your customers (as quick as 25 seconds!)

Limitations

- The customer support might not be up to the mark

- Refund processing can be delayed

- Sometimes declines transactions without specific reasons

Pricing

A fixed transaction fee of $0.30 and a variable fee between 3.29% and 5.99% of the transaction amount.

Best Suited For

Businesses aiming to offer flexible financing and installment plans as payment options.

Selecting the Right eCommerce Payment Solution for Your Online Store

When opting for an encompassing eCommerce payment solution for your online store, ponder over the following aspects:

Aspect 1: Variety of Payment Methods

Customers appreciate having a plethora of payment methods to select according to their individual preferences.

Therefore, choose a payment solution that provides a range of payment methods such as:

- Credit/Debit cards

- Internet banking

- UPI

- EMI

- Digital Wallets

Aspect 2: Fees

Every payment solution has its own pricing structure. However, the substantial expense for a business arises from the fees imposed on each transaction.

Additionally, scrutinize any recurring fees, initial fees, and installation costs that might be involved before finalizing your choice.

Be vigilant about any concealed fees.

Aspect 3: Registration and Integration Procedure

Several payment solutions are designed to be compatible with particular eCommerce platforms, and some might involve intricate integration procedures.

Hence, researching the integration and registration procedure is crucial to ensure swift operationalization of your business.

Aspect 4: Security Measures

Financial information is delicate and mandates secure handling.

Thus, your chosen payment solution should adhere to stringent data security protocols like encryption and tokenization.

Accreditations such as EMVCO 3D Secure and PCI-DSS are indicators of a payment solution’s reliability.

Aspect 5: Monitoring Mechanisms

As a vendor, monitoring substantial amounts of transactional data is imperative. Hence, a sophisticated monitoring dashboard is essential to oversee all transactions and pending settlements.

Furthermore, the dashboard should be accessible via various devices like laptops, mobiles, tablets, etc.

Time to Decide!

Armed with knowledge about premier eCommerce payment processing solutions, it’s time to discern what aligns best with your online venture.

Reflect on your business’s current stage. It aids in determining the features you require within your budget constraints.

Keeping these criteria in mind, explore payment solutions that integrate seamlessly with your store and resonate with your target demographic. After solidifying your payment methodologies, the subsequent step is to assess shipping expenses and identify optimal shipping strategies for your eCommerce. The ensuing chapter delves deeper into this topic.

FAQs

Here, we have addressed some queries you might encounter while selecting a payment solution.

Q: Which payment method is optimal for eCommerce?

A: The ideal payment method for eCommerce is contingent upon your business type and industry. Numerous eCommerce payment solutions exist, each catering to different needs. It’s crucial to assess your business’s specific needs and select a method that aligns with them. For newcomers, widely recognized solutions like PayPal or Shopify are recommended. For more established entities seeking customizable options, alternatives like Stripe are suitable.

Q: How do payment gateways differ from payment processors?

A: A payment gateway serves as the intermediary between a bank account and a payment processor, responsible for encrypting and forwarding payment details to the processor and conveying transaction outcomes back to the initiator. Conversely, payment processors facilitate information exchange between issuing and acquiring banks.

Q: Which is the most economical payment gateway?

A: Adyen is the most cost-effective payment gateway, albeit with a complex pricing structure. A simpler alternative with competitive pricing is Stripe.

Q: Which payment system is preferable for small enterprises?

A: For small enterprises, PayPal is advantageous, aiding in establishing trust among target audiences. For those with budget constraints, economical options like Adyen or Stripe are viable.

Q: Which payment gateway is the most secure?

A: Stripe and PayPal are renowned for their robust security measures, ensuring secure transactions.

Q: How do eCommerce payment systems operate?

A: eCommerce payment systems execute transactions through three fundamental steps: authorization, funding, and settlement. They submit transaction details for authorization to the issuing bank upon the merchant’s request and initiate fund transfers to the merchant’s account upon approval.

Q: Are there any complimentary eCommerce payment solutions available?

A: Google Pay and Apple Pay offer complimentary services, but integrating these solutions into your store via a payment gateway incurs charges.

Q: How can one ensure the security of an eCommerce payment solution?

A: To ensure security, opt for solutions that adhere to stringent data protection standards, employ encryption and tokenization, and possess certifications like EMVCO 3D Secure and PCI-DSS. Regularly updating security protocols and conducting security audits are also crucial.

Q: How important is user-friendliness in eCommerce payment solutions?

A: User-friendliness is paramount as it directly impacts the user experience. A user-friendly interface ensures smooth navigation, reducing transaction times and enhancing customer satisfaction, which can lead to increased conversion rates.

Q: Can the choice of a payment solution impact customer trust?

A: Absolutely. Choosing a reputable and reliable payment solution can significantly enhance customer trust. Solutions like PayPal are recognized and trusted globally, making customers more willing to complete transactions.

Q: How does the choice of payment solution affect transaction speed?

A: The selected payment solution can significantly influence transaction speed. Solutions with streamlined processes and advanced technologies ensure quick transactions, reducing waiting times and improving user experience.